Market monologues

Prologue

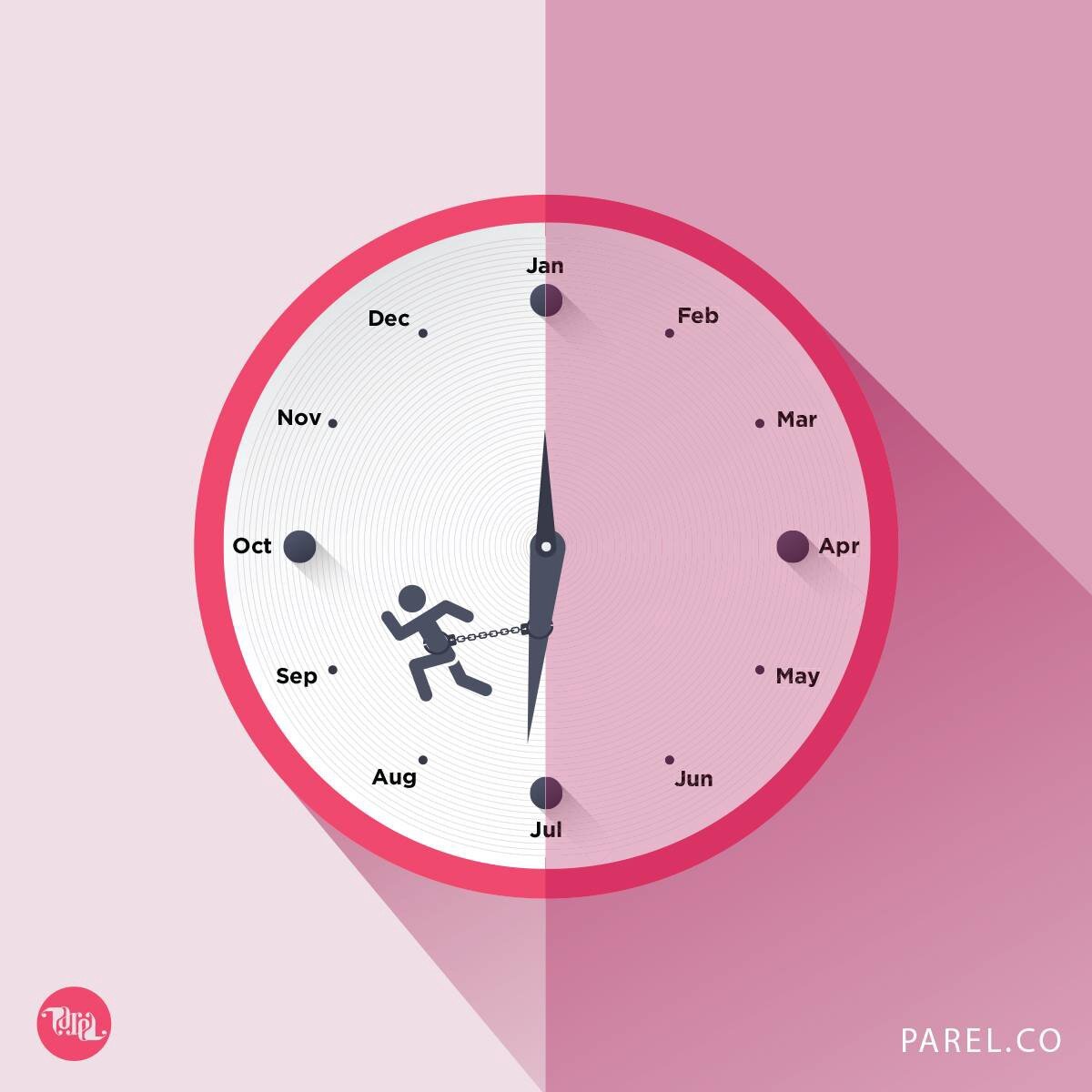

We are now in the second half of the year (or in Q3 in market short form). US stock markets are at all-time highs, a recurring feature of the last several months.

So, it’s quite natural to take stock, peer at the future and ponder as to where to invest, assuming you don’t listen to the bears, panic and sell stocks.

Covid Redux

I may be losing track, but this looks like Wave No # 4 in the US.

Covid-19 cases may continue to rise, driven by the nastily contagious Delta variant.

The good news that nearly two-thirds of the US adult population have got at least one shot and that 162 million people in the U.S. are fully vaccinated should limit the destruction. Also, so far, most who catch Covid are unvaccinated (Lo and behold no surprises!). The death rate should be lower this time because of the high rates of vaccination in older adults.

The bad news is that large numbers of younger adults falling sick could strain the healthcare system. More crucially it raises the question of whether this means a return to measures like enforced social distancing, restrictions on public gatherings, and limits on travel, slowing the economy and weakening the stock market.

Weirdly, equity investors don’t seem too concerned. Volatility is down to a preternaturally calm 18%.

Or perhaps not so weird, since John and Jane Doe firmly believe that the White House and the Fed will do whatever it takes to keep the economy propped up.

Who is afraid of inflation?

Yes, I have to speak about that 9-letter word again.

An abrupt jump in US consumer prices that started in April 2021 created fears that bond yields would push higher, denting stock valuations. But the 10-year yield has fallen to 1.2% from 1.6% over the past three months. Mr. Bond seems quite confident that faster inflation rates won’t stick.

But life is not so simple. Because while that yield dip may comfort growth investors, it raises questions about the economic recovery.

Why?

Let’s go back to the sexy world of Fixed Income 101. If the US economy is expected to splutter, then inflation -theoretically a byproduct of growth- is unlikely and similarly unlikely is an increase in interest rates. Since interest rates and bonds are as pally as a feisty mongoose and a cobra, it makes sense to gobble up long-term (read 10 years) bonds thus depressing yields because (and repeat after me this mantra) bond prices and yields move in opposite directions.

The immediate danger is that the Delta variant will spread more rapidly around the world and further disrupt global supply chains that have been strained by the pandemic. These supply-chain problems — a visible example is a shortage of computer chips — could accelerate U.S. inflation this year and further raise costs for consumers and businesses alike.

But then I recall Will Shakespeare who said, “There is nothing either good or bad but thinking makes it so.”. Perhaps we fear inflation too much. After all, the S&P 500 returned 10.4% a year over the 15 years ended 1988, when the inflation rate averaged 6.6%; then 13.6% over the next 15 years, with average inflation of 2.7%; and then 11% in the 15 years since, with inflation averaging 2%. So, stocks have held up to a variety of economic backdrops.

I don’t yet possess the ability to read minds, but the above is probably another reason equity investors don’t seem too concerned about inflation- either it won’t stick, or even if it sticks it’s no problemo.

Too rich

Many sectors look overvalued. As per Morningstar Research:

The median consumer cyclical stock trades at about 12% over its fair value

The consumer defensive sector is slightly overvalued by about 4%

The financial services sector is approx. 10% overvalued

Health care is approx. 11% overvalued and

Industrials are 17% overvalued.

The cyclical rotation that started in November 2020 was probably a short-lived phenomenon driven by recovery from an unusual recession.

Whiskey Tango Delta

Wall Street as always can’t make up its mind and provides a wide menu of choices to fit any taste (read risk appetite).

Defensive stocks such as utilities are back in favor but unless you fear Armageddon, there is no need to rush into these.

China's increased regulatory crackdown on stocks like Didi and Alibaba could drive a major rotation out of China tech stocks and into US tech stocks. FAANG stocks offer compelling value so its not a case of fools rushing in where angels fear to tread.

One thing is for sure; it is much harder to make money in today’s markets. Compared to the good old days (April 2020- November 2020.. sigh..) when even an inebriated monkey with attention deficit disorder could mint money in stocks, today’s expensive market demands deeper analysis to search for the undervalued gems.

It is hence a fab time for stock picking/stock pickers with a long-term horizon and the fundamentalists should love it.

Strategy

History shows that the longer the time frame, the better your chances of earning a decent return.

I am not kidding. Look at the numbers. Since 1950, the range of stock market returns measured by the S&P 500 in any given year has been from +47% to -39%. For any given 5-year period, however, that range is +28% to -3%—and for any given 20-year period, it is +17% to +6%.

Diversification also helps. Don’t put all your dark chocolate in one basket is the age-old adage that must be remembered.

But whether you find the case for value or cyclical or tech more attractive, just don’t flee stocks.

And oh yes, stay fundamental!

Image Credits: http://parel.co